BANK OF ENGLAND RATE HIKES: AN ANALYSIS OF THE CONSEQUENCES ON A EUROPEAN PORTFOLIO

Can a CTA allocation improve portfolio performance in crisis?

Apr 2022, By AlternativeSoft

Introduction:

On the 16th of March, the Bank of England further increased its deposit rate to 0.75% after the increase to 0.50% that took place in February. With the aim of counteracting the throttling inflation exacerbated by the Ukrainian conflict.

Increasing the bank rate is seen by investors as a double-edged sword because although it is considered the standard response to incentivise savings over consumption and alleviate demand-push inflation, it simultaneously makes corporate borrowing more expensive, thus negatively impacting business profitability and decreasing the value of outstanding bonds due to the higher discounting rate.

So how can an investor use state-of-the-art analytical tools to navigate to protect themselves, and profit, during periods of increasing interest rates? In this article we use AlternativeSoft to analyse the impact of this rate increase on a typical European investor portfolio and evaluate different strategies to hedge the portfolio against further increases that could take place.

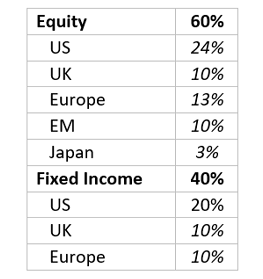

We start from a standard 60/40 portfolio invested as follows:

The time period for this portfolio will span ten years, from March 2012 to February 2022. During this time period we used...

To read more, please fill out the form below...

Users

Awards

Companies

AuM Worldwide

Fund Investing, Simplified

But don’t just take our word for it. Try it for free

Get in touch

Office Location

EC3R 6AF