Funds' Investment

Simplified

Used by institutional investors to create a personalized investment universe

Welcome to AlternativeSoft, your trusted partner in maximizing investment success for Pension Funds. Our cutting-edge solutions are tailored to address the unique challenges faced by institutions like yours in the ever-evolving investment landscape.

You are visiting the SIPUG 2023 in Zurich and you wanted to learn more about our solutions dedicated to pension funds investing in funds.

Why Choose Us?

- A seamlessly intuitive user experience.

- Winner of the Best Risk Management Solution 10 Times, including each of the last 4 years.

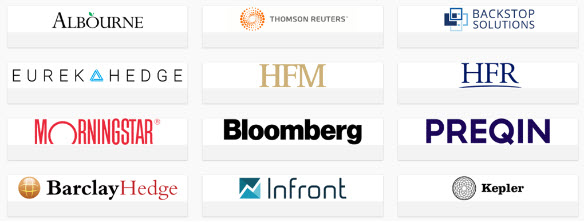

- The only solution that aggregates data from any source, including Excel, Bloomberg, Morningstar, Preqin, HFM, Albourne and more.

- Unlimited support from our Client Success Team.

- No Installation fees.

- Over 600 users worldwide.

- Used by 5 of the 10 largest fund allocators in the world.

Our Clients

.png)

Data Integration and Customization

-

Access accurate and up-to-date market data seamlessly through integration with leading providers.

-

Customize the solution to align with your specific investment strategies and preferences.

Insights from Robust Data

- Gain unparalleled insights into your investment portfolio, identify performance drivers, and assess risk exposure with our powerful analytics tools.

- Funds aggregated from Morningstar, Bloomberg, Refinitiv, HFR, With Intelligence, Albourne, Preqin and Pitchbook.

- Our advanced algorithms crunch the numbers to provide you with actionable insights, helping you identify trends, correlations, and opportunities that might otherwise go unnoticed.

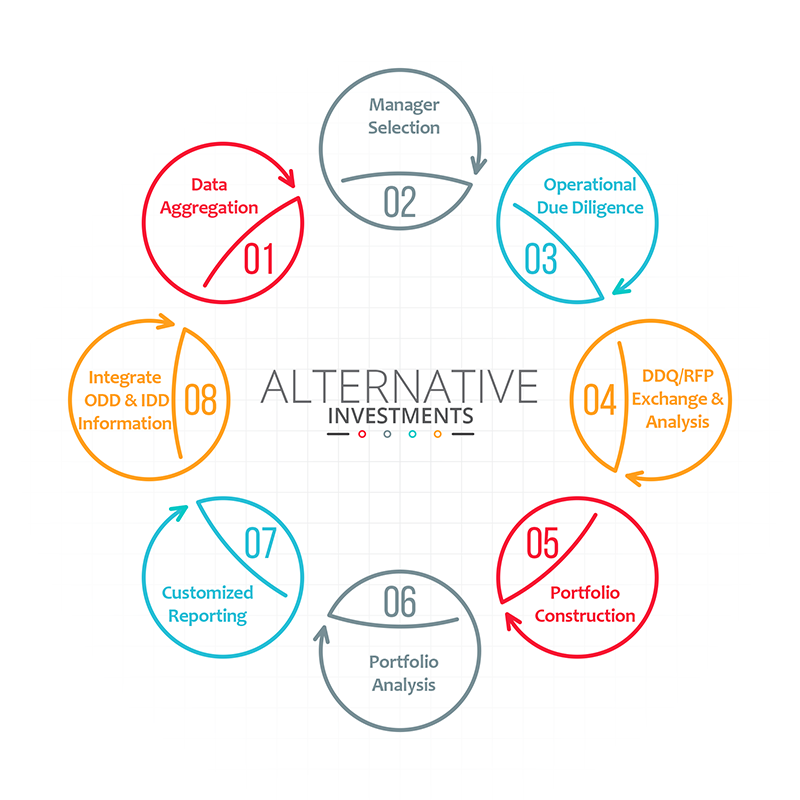

Streamlined Funds' Manager Selection

-

Make confident decisions in choosing alternative investment managers using our robust screening and due diligence platform.

-

Compare managers based on a comprehensive set of factors and build diversified portfolios.

Gain Confidence and Clarity:

- Power BI: Add a more deep dive analysis into your existing dashboards, and your existing reports.

- Excel API: Flexible, easy to use, and infinitely customisable (with hundreds of functions available.)

- Automated Reports: Schedule and automate up to 100 fund or portfolio reports at once.

- Templates: Automate the creation of bespoke templates to facilitate the production of fact sheets, portfolio reports, fund peer group analysis, exposure analysis, and stress testing. (Over 50 free templates provided covering fact sheets, portfolio reports, fund peer group analysis, exposure analysis, and stress testing).

- Free white-labelled fact sheets.

Build Portfolios

- Optimize portfolios on an ex-ante or ex-post basis against 11 different risk engines.

- Decompose risk and return attribution.

- Create and analyze ‘what if’ scenarios for your portfolio.

- Break down all of your portfolio’s cash flows in one screen.

- Analyse the impacts of allocation decisions and how adding or removing managers can impact your portfolio’s risk/return profile.

- Create and customise composite benchmarks.

- Creating Composite Benchmarks.

- Create and customize portfolio fact sheets to share with stakeholders.

.png?width=659&height=420&name=Portfolio-Construction-laptop%20(1).png)

.png?width=409&height=250&name=due-diligence%20(2).png)

Connect with managers via our audited digital Operational Due Diligence platform:

- Leverage AlternativeSoft’s secure peer-to-peer Operational Due Diligence platform in order to seamlessly exchange documentation, DDQs and key investor data.

Our Awards

.jpg)

Request Your Web Demonstration

Office Location

UK: 10 Lower Thames Street,

London, EC3R 6AF

USA: 1 Mid America Plaza, Suite 3016

Oakbrook Terrace, IL 60181

.png)